The threat of impending recession

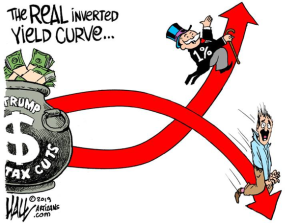

The economic analysis pages of the bourgeois media are predicting a huge economic downturn in the near future, with an end to the supposed ‘recovery’ from the financial crisis that erupted in 2007-8. The harbinger of doom is the ‘inverted yield curve’ that we are told has presaged every other recession there has ever been. The other ominous sign is that in many countries banks are offering their depositors only negative interest rates, i.e., requiring them to pay for the privilege of depositing money in the bank, rather than compensating them for giving the banks the use of their money.

The economic analysis pages of the bourgeois media are predicting a huge economic downturn in the near future, with an end to the supposed ‘recovery’ from the financial crisis that erupted in 2007-8. The harbinger of doom is the ‘inverted yield curve’ that we are told has presaged every other recession there has ever been. The other ominous sign is that in many countries banks are offering their depositors only negative interest rates, i.e., requiring them to pay for the privilege of depositing money in the bank, rather than compensating them for giving the banks the use of their money.

There is no doubt that this situation is highly unusual, but how exactly has it come about?

Banks are at the present time most unusually able to secure deposits of cash despite negative interest rates, and states are able to borrow albeit offering long-term interest rates that are much lower than normal because, from the point of view of the provider of the money (the lender), that money is safer invested in that way than invested in stocks and shares (equities) or engaging in the business of creating surplus value by the exploitation of labour power. Normally investment in production is preferred for the purpose of acquiring a return on investment because profits in the production process tend to be higher than loan interest. Money invested in the production process is more at risk than that lent to the government of an imperialist country which is perceived to be unlikely to default. The risk arises from the unavoidable fact that with production there is always the danger that overproduction will make the product unsaleable and the surplus value unrealisable leading to investors losing their capital altogether. Smelling in the air a deepening of the overproduction crisis, investors are fleeing to the relative safety of sovereign bonds, bank deposits and precious metals, even though these offer low or no returns.

Marxist theory, backed up by the living experience of capitalism over the last almost 200 years, shows that capitalism is a system encompassing alternate periods of boom and bust. “…,the ever increasing perfectibility of modern machinery is, by the anarchy of social production, turned into a compulsory law that forces the individual industrial capitalist always to improve his machinery, always to increase its productive force. The bare possibility of extending the field of production is transformed for him into a similar compulsory law. The enormous expansive force of modern industry, compared with which that of gases is mere child’s play, appears to us now as a necessity for expansion, both qualitative and quantitative, that laughs at all resistance. Such resistance is offered by consumption, by sales, by the markets for the products of modern industry. But the capacity for extension, extensive and intensive, of the markets is primarily governed by quite different laws that work much less energetically. The extension of the markets cannot keep pace with the extension of production. The collision becomes inevitable, and as this cannot produce any real solution so long as it does not break in pieces the capitalist mode of production, the collisions become periodic. Capitalist production has begotten another ‘vicious circle’” (Engels, Anti-Dühring).

Bourgeois economists, however, of whom Keynes is perhaps the most prominent, have developed all kinds of ‘tools’ through which it is claimed they can avoid crisis, or at least minimise its effects. All you have to do, according to these economists, is to take steps to boost purchasing power artificially so that the ill effects of overproduction are avoided. There are a number of ways that purchasing power can be boosted: the government can undertake public works, boosting demand in the economy both by putting wages in the pockets of labourers undertaking these works and by buying the necessary materials for the work to be done; it can lower taxes so that people have more purchasing power; it can require the state bank to lower interest rates both so that people have more purchasing power and are encouraged to borrow to acquire still more, and so that the industrial capitalists’ profits get a boost. There is also the untried possibility of ‘helicopter money’ – i.e., giveaways of money so that people can spend it. This is now being mooted in the form of the universal income.

The problem is that all of these fixes come with a price tag. The US government can always print money to cover the cost but the inevitable effect of doing so is inflation. Marxism shows that on average commodities sell at their value, with the actual price fluctuating above or below value according to the balance of supply and demand. Obviously where there is a crisis of overproduction the price should fall as supply grossly exceeds demand. If the government increases the money supply to prevent the fall in prices, this will tend to devalue the money towards the level that the price would have fallen to had it not been for the artificial boost.

If as a means of boosting demand, money is lent from the vast stores of it that accumulate when overproduction has made industrial investment unattractive, this may indeed boost short term demand and help maintain prices. But in the longer term it takes demand out of the economy as the debt has to be repaid, and repaid with interest, leaving potential consumers with much less to spend.

But still, a fall in the exchange rate of a country’s currency can improve its export potential, reduce its imports, improve its balance of payments, reduce its deficit, and thereby help to improve its financial position, albeit temporarily.

Experience therefore has shown that the effectiveness of these attempts to stem the tide of overproduction is like trying to keep an old car going after it starts leaking oil. You keep a gallon of oil in the boot and keep topping up; you spend a fortune on repeated visits to the repair shop; but in the end you have to admit that your old banger has come, so to speak, to the end of the road.

US attempts to stave off recession

And there are those financial commentators in the bourgeois media who are becoming increasingly convinced that this is where we will shortly be arriving: according to Jeremy Warner writing in the Telegraph, Donald Trump has “run out of road for further fiscal stimulus”. To try to keep his electoral base happy – in the hope of being re-elected next year – Trump has been spending government money like there was no tomorrow. He has lowered taxes, he has paid billions in compensation to soya bean farmers who have lost out as a result of Chinese retaliation to the trade war Trump has initiated. The US government has had to lift the government’s borrowing ceiling by $320 billion to enable it to fulfil its budget plans for the next two years. This puts the US government $22 trillion in debt, with interest costs in the billions that have to be paid either at the expense of the US taxpayer or by incurring still more debt.

And the debt keeps on growing. The budget deficit (the annual government overspend) through June of this fiscal year reached $746 billion, up from $607 billion at the same time last year. To avoid default, the US government just keeps on borrowing, like the apocryphal lady on benefits who maxes out credit card after credit card living the high life, but ever able to borrow yet more to pay off existing credit card debts plus interest and then some. So long as she can keep on borrowing money increasing indebtedness that she will never be able to extinguish, she doesn’t have a care in the world – and so it is with the US government.

As Peter Koenig writes in Global Research (‘The world is dedollarizing’, 19 July 2019), “Today, the dollar is based not even on hot air and is worth less than the paper it is printed on. The US GDP is US$ 21.1 trillion in 2019 (World Bank estimate), with current debt of 22.0 trillion, or about 105% of GDP. … According to Forbes, about US$ 210 trillion are ‘unfunded liabilities’ (net present value of future projected but unfunded obligations (75 years), mainly social security, Medicaid and accumulated interest on debt), a figure about 10 times the US GDP, or two and a half times the world’s economic output.

“This figure keeps growing, as interest on debt is compounded, forming part of what would be called in business terms ‘debt service’ (interest and debt amortization), but is never ‘paid back’. ….

“This monstrous debt is partly owned in the form of treasury bonds as foreign exchange reserves by countries around the world. The bulk of it is owed by the US to itself – with no plans to ever ‘pay it back’ – but rather create more money, more debt, with which to pay for the non-stop wars, weapon manufacturing and lie-propaganda to keep the populace quiet and in lockstep.

“This amounts to a humongous worldwide dollar-based pyramid system”.

As with the lady on benefits, the time will eventually come when the lenders get cold feet and stop lending, realising that not only will they never be repaid their capital, but the borrower is more and more likely to default even on interest payments. In the meantime it’s anybody’s guess when the music will stop.

Trump’s extravagance with government money left it seriously short and in danger of defaulting were he unable to secure permission to borrow this additional $320 billion. It seems that to ensure it never finds itself unable to pay its bills, the US government needs to keep some $400 billion in its current account (its General Trading Account –GTA – at the Federal Reserve) but this had been run down to $210 billion by the end of July 2019. This is more or less the amount that the US government spends in a single month! Without the extra borrowing it would have run out of cash to pay its day-to-day expenses by the end of September and would be forced to default.

However, when the government pays money into its GTA, that money is taken out of circulation and reduces demand. This is why Trump is attempting to insist that the Fed lower its interest rates still further than the 0.25 points by which it lowered them in July. The money the government will be squirreling away in the GTA needs to be countered by additional liquidity emanating from a further lowering of interest rates by the Fed.

Drawbacks of lowering Treasury interest rates

The Fed, however, has been resisting this move, leading Trump to an extraordinarily intemperate denunciation of Powell, the Fed’s chief:

“Jerome H. Powell, the Federal Reserve chair, kept future interest rate cuts squarely on the table … but suggested that the central bank was limited in its ability to counteract President Trump’s trade policies, which are stoking uncertainty and posing risks to the economic outlook.

“Mr Powell’s remarks drew a swift and angry reaction from Mr. Trump, who equated the Fed leader with the president’s adversary in the trade war, President Xi Jinping of China.

“’My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?,’ Mr. Trump wrote in one of a series of Twitter posts” (Jeanna Smialek, ‘Powell highlights Fed’s limits. Trump labels him an “enemy”’, New York Times, 23 August 2019).

The Fed’s objection to reducing interest rates further in order to increase demand in the economy is that this will of course fuel inflation to levels the Fed considers unacceptable. Nevertheless, inflation can benefit the US economy in a number of ways, even if it does make imports more expensive. First and foremost it makes US exports cheaper and therefore more competitive.

What the Fed is afraid of, however, is that it lessens the value of the debts owed by the US Treasury to foreign lenders perhaps causing the latter to hesitate to lend anything further in the future. If the US’s creditors get cold feet, like the lenders advancing endless money to our lady on benefits, then the whole house of cards comes tumbling down. For the moment there is little likelihood of this because apart from precious metals there are no real competing ‘safe havens’ wherein investors can park their idle capital, but if the ‘safe haven’ begins to get more and more unsafe, eventually the tide will turn. And already the price of gold has leapt this year from $1,278.30 per ounce on 1 January to over $1,500.

| Foreign owners of US Treasuries | |||

| Rank | Country | US debt holdings | Percentage of foreign US debt held |

| 1 | China | $1.11 trillion | 17.30% |

| 2 | Japan | $1.06 trillion | 16.50% |

| 3 | Brazil | $307 billion | 4.80% |

| 4 | United Kingdom | $301 billion | 4.70% |

| 5 | Ireland | $270 billion | 4.20% |

| 6 | Switzerland | $227 billion | 3.50% |

| 7 | Luxembourg | $224 billion | 3.50% |

| 8 | Cayman Islands | $217 billion | 3.40% |

| 9 | Hong Kong | $206 billion | 3.20% |

| 10 | Belgium | $180 billion | 2.80% |

| 11 | Saudi Arabia | $177 billion | 2.80% |

| 12 | Taiwan | $171 billion | 2.70% |

Interestingly, the purchase by these countries of US debt not only funds the US’s extravagant lifestyle but also tends to increase the exchange rate of the dollar since foreign currencies have to be converted into dollars in order to make the investment.

What is also bothering the Fed is that it is gradually being deprived of the ‘tools’ it needs for giving the economy a boost as and when needed. Bourgeois economists term as a ‘natural rate of interest’ one which will help keep the general price of commodities level – not rising much and not falling at all. The Fed has found, however, that this so-called ‘natural rate of interest’ has been falling lower and lower over time, as the New York Times explains:

“The Fed policy setting that neither stokes nor reins in growth has been creeping lower as growth slows, a trend that has been slowly playing out for years across advanced economies.

“That’s why policymakers have not been able to lift rates more despite a very long expansion: The economy needs very low rates just to sustain historically ho-hum progress. And it leaves the Fed with far less ammunition to fight future downturns. Gone are the days of cutting 5 percentage points to goad growth back to life, as the Fed did in 2007 and 2008” (Jeanna Smialek, ‘Fed poised to cut rates for first time since financial crisis, ending an era‘, 28 July 2019).

Falling interest rates linked to falling profits

The explanation for this is that interest rates have to fall as the rate of profit falls.

In order to explain why the rate of profit tends to fall, Marx used the terms ‘constant capital’ (i.e., the value of fixed assets and raw materials consumed in production) and ‘variable capital’ (i.e., wages), as well as the ‘organic composition of capital’ which was the ratio of constant capital to variable capital:

“… it is a law of capitalist production that its development is attended by a relative decrease of variable in relation to constant capital, and consequently to the total capital set in motion. This is just another way of saying that owing to the distinctive methods of production developing in the capitalist system the same number of labourers, i.e., the same quantity of labour-power set in motion by a variable capital of a given value, operate, work up and productively consume in the same time span an ever-increasing quantity of means of labour, machinery and fixed capital of all sorts, raw and auxiliary materials-and consequently a constant capital of an ever-increasing value.

“This continual relative decrease of the variable capital vis-à-vis the constant, and consequently the total capital, is identical with the progressively higher organic composition of the social capital in its average. It is likewise just another expression for the progressive development of the social productivity of labour, which is demonstrated precisely by the fact that the same number of labourers, in the same time, i.e., with less labour, convert an ever-increasing quantity of raw and auxiliary materials into products, thanks to the growing application of machinery and fixed capital in general. To this growing quantity of value of the constant capital – although indicating the growth of the real mass of use-values of which the constant capital materially consists only approximately – corresponds a progressive cheapening of products. Every individual product, considered by itself, contains a smaller quantity of labour than it did on a lower level of production, where the capital invested in wages occupies a far greater place compared to the capital invested in means of production. … This mode of production produces a progressive relative decrease of the variable capital as compared to the constant capital, and consequently a continuously rising organic composition of the total capital. The immediate result of this is that the rate of surplus-value, at the same, or even a rising, degree of labour exploitation, is represented by a continually falling general rate of profit…

“The progressive tendency of the general rate of profit to fall is, therefore, just an expression peculiar to the capitalist mode of production of the progressive development of the social productivity of labour…

“Since the mass of the employed living labour is continually on the decline as compared to the mass of materialised labour set in motion by it, i.e., to the productively consumed means of production, it follows that the portion of living labour, unpaid and congealed in surplus-value, must also be continually on the decrease compared to the amount of value represented by the invested total capital. Since the ratio of the mass of surplus-value to the value of the invested total capital forms the rate of profit, this rate must constantly fall.”

To get the most out of his capital investment, therefore, the capitalist must spread its cost over a much larger quantity of commodities produced to ensure they are competitively priced notwithstanding his huge capital outlay, and also to produce at least the average rate of profit even though he is in relation to his capital expenditure employing fewer surplus-value generating workers. This is why capitalism has continuously to expand in order to stay still. And it is beset by periodic crises when expansion is no longer possible because of failing demand and economies the world over go into ‘recession’, leading to mass business closures, insolvencies, redundancies, falling tax income and austerity.

The reason interest rates tend to fall as the rate of profit falls is that interest needs to be more than covered by the rate of profit. There would be no point in borrowing if interest could only be repaid out of capital. So as the rate of profit falls, the ‘natural’ rate of interest necessarily falls also.

At the same time, the point comes when the gigantic expansion of capital is brought to a halt because it has outstripped the available market, the purchasing power of consumers which expands “far less energetically”, with the result, as stated above, that the capital invested is dissipated because products can’t be sold in sufficient quantities and at sufficient prices either to bring a profit or even to restore the original capital outlay, whereupon bankruptcy follows bankruptcy and business activity slows down significantly.

Worldwide economic slowdown

There is already plenty of evidence around the world of a disastrous fall in business activity starting with reports of much reduced freight levels. Freight volumes are falling precipitously within the US and across much of the world as economic slowdown spreads, hitting levels that typically mark the onset of recession.

“The US Cass Freight Index fell for the seventh month in June and is now down 5.3pc over the past year. ‘More and more data are indicating that this is the beginning of an economic contraction,’ said the June report by Cass Information Systems ….

“The American Trucking Associations’ tonnage index fell 6.1pc in May. Spot contract rates for booking lorry space plunged 18pc in June. There has been a wave of truck foreclosures on small driver-owner firms caught in the squeeze” (Ambrose Evans Pritchard, ‘Global freight slide nears recession levels as trade war damage deepens’, Telegraph, 18 July 2019).

And it is not just US freight statistics signalling a gloomy economic outlook:

“Cass said its European Airfreight Index fell to minus 7.9pc last month, while the data from the Pacific Rim is even worse. ‘Air freight volumes in Asia suggest that the region is on the verge of, or is already entering, a recession,’ it said.

“Asian air freight dropped to minus 8.6pc …” (ibid.)

As a result, concludes the same article: “The New York Fed’s gauge of recession risk a year ahead has rocketed to 33pc, a level that has invariably been followed by actual downturns over recent history.”

Europe is also in the economic doldrums: “Factory activity in the eurozone has collapsed to its lowest level in seven years on the back of what appeared to be a deepening of Germany’s industrial recession.

“The purchasing managers’ index for manufacturing in the euro area shrank for a sixth month and at its sharpest rate since late 2012. The reading fell from 47.6 to 46.4, below all forecasts and beneath the 50 level that separates contraction from expansion. Factory PMIs in Germany also hit a seven-year low in a sign that the bloc’s largest economy is deteriorating” (Philip Aldrick, ‘Eurozone factory activity falls as German manufacturing slows‘, The Times, 25 July 2019).

The massive problems being experienced by the car industry are well known, but the severity of overproduction in that industry is well illustrated by the following facts reported from China:

“China’s shrinking car market is hitting foreign manufacturing groups hard, with some companies operating at a fraction of their potential output, sparking fears a number will be forced to quit the world’s biggest market…

“Ford’s plants in China operated at 11 per cent of their potential output in the first half of the year, according to a Financial Times analysis of production data from its joint venture partner Chang’an Auto. Ford’s China sales fell 27 per cent year on year in the first half.

“PSA’s plant with Chang’an produced just 102 cars in the first half of the year, according to China’s official auto industry association, meaning capacity use fell below 1 per cent. Its other joint venture with Dongfeng Auto ran at 22 per cent capacity. The group said China sales were down 62 per cent in the first half.

“Factories generally need to operate at above 80 per cent capacity to break even, highlighting the extent of the problems facing Ford and PSA, analysts say” (Tom Hancock, Wang Xueqiao and Qian’er Liu, ‘Shrinking Chinese car market sparks fears over foreign groups’ future‘, Financial Times, 28 July 2019).

All this is ominous because if production slows, profits must necessarily be reduced in overall quantity, leaving not only the manufacturer out of pocket, but also all those entitled to take a share of those profits – the distributors, the lenders, the landlords, the shareholders, all of which translates for the working class into mass layoffs and eye-watering austerity.

It is time to face it – capitalism must go!