Food and farming in Britain – the lamentable situation and how the market brought us here

Britain has some of the best agricultural land in the world, so why is it that more than one third of the food consumed here is imported?

The headline figure from a 2024 report issued by Defra (the Department for the Environment, Food, Rural and Agricultural affairs), is that only 62% of the food consumed here is actually grown here. This is the lowest it has been for some time, falling from 80% in 1945 (1). To understand what is driving this, and crucially how the political economy of capitalist agriculture has necessarily created such a situation, we first need to understand exactly what the figures represent. The 62% is a ‘production to supply ratio’ and there are two things to bear in mind. Firstly it uses the market prices of commodities, this means that relatively expensive foods are overweighted compared to cheaper ones. Secondly there are foods that can not be grown here (e.g.: rice, bananas, cocoa, coffee, etc.) which are nonetheless consumed here. These obviously have a production to supply ratio of 0% which brings down the average. Taking just ‘indigenous crops’ that can be grown in Britain, the overall production to supply ratio is 75%. Both of these points will be returned to, as we take a look at food production sector by sector.

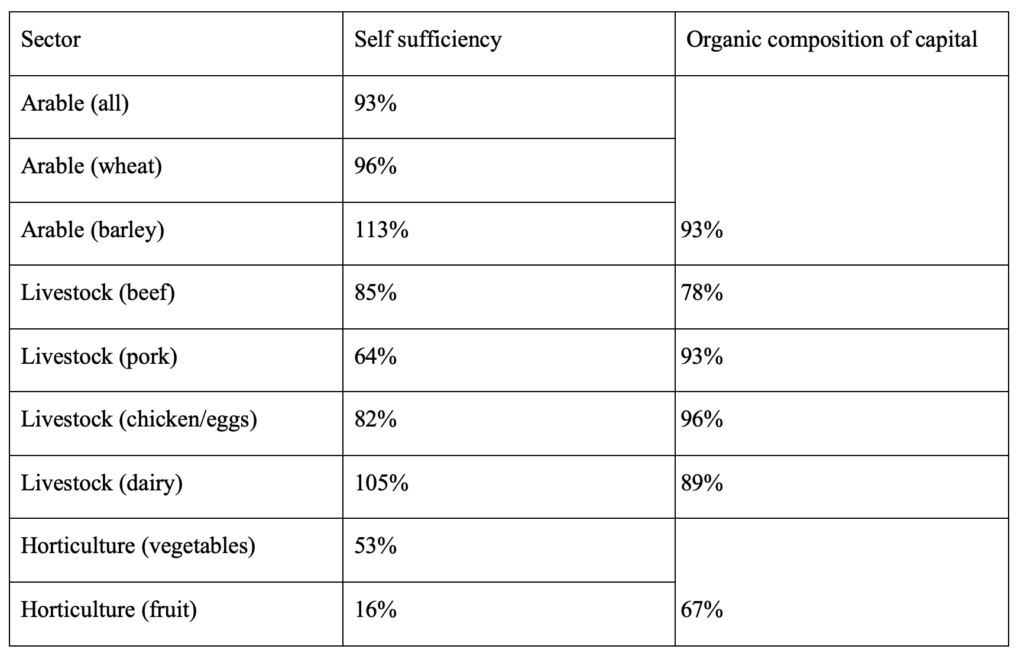

First, Britain is not very far from being self-sufficient in arable crops (Table 1), these include most staples and account for a very large part of the land used for agriculture. Britain is also a net exporter of dairy produce and produces more meat than the overall production to supply ratio suggests with 85% of beef, 82% of chicken, and 64% of pork consumed in Britain being produced here (Table 1). The sectors that bring the average down are vegetables (only 53%) and fruit (just 16%). Before considering how this came about, and why it is the case that only socialism can reverse it, there are some more things to bear in mind about each of the sectors.

The overall figure for arable of 93% is brought down by relatively large quantities of non-indigenous cereals being imported (mainly rice) so most indigenous arable crops are very close to self-sufficiency and only a small amount of extra land would be needed to produce enough. The biggest issue facing self-sufficiency in cereals and other arable crops is our reliance on imported inputs, mainly fertilisers and machinery. Imports account for 50% of Britain’s nitrogen fertilisers, a mix of finished ammonium nitrates and ammonia to supply the one remaining ammonium nitrate plant in Britain (CF Fertilisers in Teeside, which ceased ammonium production in 2019). The only remaining domestic source of nitrogenous fertilisers is the remaining 50% which comes from animal manures (2). For phosphorus, 20% is imported mined rock phosphorus, for which there are no deposits in Britain, the remainder coming again from animal manures. It is not straightforward to work out how much of the agricultural machinery used in Britain is produced domestically but it is certainly a small amount. Taking tractors as an example, there are only two remaining tractor assembly plants in Britain (the New Holland plant in Essex and the JCB Fastrac plant in Staffordshire) and both of these merely assemble finished tractors mostly from imported parts.

Turning to the livestock sector, recall that these production to supply ratios used by Defra use market prices, which causes the ratios to underestimate actual self-sufficiency for all types of meat, due to ‘carcass balance’ – whole animals are raised but cheaper cuts of meat are exported and more expensive ones imported. By way of example consider a country that produces enough whole chickens to satisfy its population (i.e. has production to supply ratio of 100%), but instead exported the legs for half the price at which it imported breasts to make up the shortage, by market prices the production to supply ratio would fall to 75% (assuming breasts to be essentially double the price of legs, for the equivalent weight of meat, in this example). This effect operates across all types of livestock used for meat, but it’s hard from the available data to work out how large of an effect it has. A second important consideration is that all of the livestock sectors, but especially pigs and chickens are heavily dependent on imported non-indigenous soya. For the last 20 years our imports of soya have remained fairly stable fluctuating around the level of just over 1 million tonnes per year (3).

Finally for vegetables and fruit, as well as not producing nearly enough we don’t consume enough – on average, Britons need 30% more fruit and vegetables in our diets by weight to meet current government guidelines (4). Across all the sectors, partly owing to seasonality, horticulture is most reliant on casual labour with an estimated 29% percent of wages paid to casual labourers (5), a large proportion of whom are migrant workers paid less than the national living wage on six-month Seasonal Worker Visas, of which 45,000 were issued for the horticultural sector in 2024 (6).

Capital intensive farming and the falling rate of profit

While all kinds of factors might affect the pattern of self-sufficiency across sectors (e.g. trade regulations, shelf life, transport costs) one that is particularly pertinent is the organic composition of capital. The organic composition of capital is the proportion of the capital used in production that is not paid as wages, such that, across sectors, a higher organic composition of capital implies a less labour-intensive sector. Here we can see the most self-sufficient sector (arable farming) is, on average, the least labour intensive and conversely the least self-sufficient (horticulture) is the most labour intensive (Table 1). Generally speaking we would expect industries with a higher organic composition of capital to return lower profits. This is because, the rate of profit is equal to the surplus value (accrued from the unpaid work, or ‘surplus labour’ of workers) divided by the total capital employed, therefore, assuming similar rates of surplus value per unit of labour power, as the ratio of the total capital to labour power employed rises, profits fall (7).

Subsidies

Here it is worth touching on the role of subsidies, in 2024 total subsidies paid to farmers came to £3.025 bn while total net profits to farmers (from agriculture) were £4.291 bn – meaning that over 70% of the profits to farmers come from state-funded subsidies, an equivalent of raising the average rate of profit from 4% (without subsidy) to 14% (with subsidy) (8).

So, in synthesis, what has happened is that the parts of British agriculture that require the most labour have been moved to countries where lower wages can be paid so that higher profits can be made. The parts of those sectors that remain here are propped up by being able to hyper-exploit migrant labourers. Since the sectors that remain are those that rely more heavily on costly machinery and other inputs and relatively little labour they necessarily return low rates of profit which are boosted with subsidies so that farming remains an attractive industry in which to invest capital.

It should be noted that individual farm capitalists, who have to invest capital in machinery and other inputs, typically do so on loans secured against their land. Once the City of London has taken its cut through interest, they may well be operating on lower margins. That is particularly the case with those farmers at the lower margin of existence – although these are already very sizeable farms in Britain. We have almost no truly small farmers, and hence no real ‘peasantry’ to speak of, although we do have a class of agricultural workers or ‘rural proletarians’.

The price of land

On the subject of financialisation it is worth quickly examining the price of agricultural land. Marx described land prices as ‘capitalised rent’ meaning that the price of a piece of land is determined by the rent it can accrue, such that the rate of return to the purchaser would be the same as any other purchasable asset. An exception which Marx explicitly leaves out of this analysis is ‘land speculation’ in which an investor might pay more for a piece of land than its capitalised rent is worth (9), speculating on an even higher price in the future. Using data for 2024 the average rent for arable land in England was £250/hectare (10) and average sale price of arable land in England was £24,024/hectare (11). Capitalised rent without speculation implies a return on investment of just 1.04% – well below most savings rates, never mind the return from capital in the form of stocks and shares. However if we instead factor in the inflation of the price of land, i.e. the object of speculation, then we can see that farmland yields a return on investment similar to other assets, with only a 3.2% difference in total growth over the ten years to 2024 between a farmland price index and the FTSE100 (12).

Inflation of land prices creates the conditions for the further financialisation of farming as land-owning farmers can then secure larger loans against their land to finance their machinery and other fixed capital. So on the one hand finance capital inflates the price of farmland beyond the value of its productive use (i.e. above capitalised rent) but simultaneously by driving up the price of land it creates conditions for greater levels of land-secured debt to extract value from farming not just through land rents but by loan interest.

Speculation in commodities (gold for example) is a feature of the monopoly capitalist economy in crisis. It is notable that the world’s richest companies and individuals are finding that land, being a natural monopoly, is the commodity of choice in which to invest vast hoards of unproductive capital. This (together with inflation) is the basis for the huge speculative house prices in our cities, ballooning speculation in land, and indeed a lucrative aspect of the wars being waged by our imperialist class around the world. Ukraine is a striking example, with the formerly nationalised Soviet land, the basis of the Soviet people’s wealth and wellbeing, now being owned principally by Western oligarchs, hedge-funds and giant agribusiness, notably Bill Gates, Blackrock and Monsanto (13).

Changes in taxation and subsidy – a spur to further monopolisation

In this context, it is worth briefly analysing the current direction of state agricultural policy in Britain. The two major imminent changes are the removal of Inheritance Tax exemption for all agricultural business assets over £1M, which is due to enter the tax code in 2026, and the staged withdrawal of subsidies such as the Basic Farm Payment in favour of a subsidy regime based around the principle of ‘public money for public goods’ where farmers are paid for providing socially beneficial things such as better environmental conditions. Superficially, these policies can be read as being broadly progressive. Inheritance Tax is one of the few policy instruments that the state uses to expropriate assets from its own ruling class, and as we have just seen subsidies represent a significant boost to the incomes of already profitable businesses that cause significant environmental harm and typically belong to very wealthy people. So, is this a shift in favour of ‘tax fairness’ and sound environmental policy? Or as some of the more hysterical reactionaries have asked (14), is Keir Starmer “setting out to abolish private property and liquidate the kulaks of Britain”?! While the working class need have no sympathy for the capitalist farmers who are set to lose out significantly from these changes, communists need to look beyond the superficial winners and losers and understand how these policies will function in the broader political economy of British agriculture.

The changes to Inheritance Tax are quite simple. At the moment all agricultural business assets, such as land, machinery, and buildings are exempt from Inheritance Tax, but from next year all these assets over an allowance of £1M will be taxed at 20% when their owner dies. The inheritor does get 10 years over which they can pay, but since rates of profit are low, especially without subsidy, it follows that many farms will be forced to sell land or take on debt to meet the tax bill. Since 40% of farmers are over 65 (15), this will provide a steady stream of agricultural land for purchase by investors, who in every investor report lament the low volume for sale while delighting in the steady returns at comparatively low risk (16). Whether by directly purchasing land or extracting surplus value through interest on new loans secured against it, these tax changes are guaranteed to drive more of the profits from farming out of individual farm businesses and into the hands of corporate finance capital.

The shift from subsidies to a public goods model has been on the agenda since Brexit. On the one hand it represents a break from the European Union’s Common Agricultural Policy, but it can also be viewed as a continuation of the direction of reform of the CAP that has also been taking place inside the EU, where over several rounds of reform, subsidies have been gradually detached from production and increasingly made conditional on ‘greening’ and ‘sustainability’.

Since Britain’s exit from the EU, under the Environment Act 2021, more of the subsidy budget is targeted to competitive schemes and locally planned interventions to generate environmental benefits where they will be most effective. From the point of view of addressing the very real problems of environmentally unsound farming practices, like the previous reforms, this is potentially beneficial. So is it correct to see this simply as a technocratic project driven by environmental concern, or do we need to ‘follow the money’?

One of the dramatic changes brought in by the Environment Act is the extent to which subsidies are concentrated in fewer hands. While ten years ago farmers were subsidised at a flat rate per hectare for different agroecological options they could choose, now larger farms are set to receive a greater part of the subsidy. As an example, Landscape Recovery, a flagship policy from the Environment Act, the minimum package requires 500 ha of farmland to be taken out of agriculture for producing public goods (17). This means that to compete for these subsidies most farmers must cooperate with their neighbours to come up with a carefully designed plan at scale and only the largest estates, generally in the hands of the aristocracy, financial trusts and other monopoly capitalists, are able to compete without coordinating across a range of different independent operations. As we saw above, profits from farming without subsidies are very low, so lower rates of subsidy mean that smaller farms are going to be increasingly unprofitable and unable to raise the capital required to farm them, resulting in a further concentration of monopolist control over farming and land.

Farming at Scale: Capitalist monopolisation vs Socialist state farming

While it should not be a surprise that the agricultural policies of an imperialist state create the conditions for finance capitalists to bolster their flagging profits, we also need to recognise that beneath this is a material contradiction. Taking a scientific approach to using land to meet environmental goals, whether that means reversing biodiversity declines, fixing carbon, or protecting watercourses etc, actually does require joined up and targeted action at larger scales than all but the largest farms occupy. Bigger farming operations are therefore actually better suited to addressing environmental challenges – yet it is capitalist relations in agriculture that tie concentration of the land into bigger farms to declining food sovereignty.

When we analyse the material conditions of farming and its finance we clearly see that the forces and processes driving the degradation of agriculture in Britain and its disastrous effects on our food security are the very same forces which have laid waste to the rest of our industries. Namely the rule of finance capital and the ensuing export of capital. In addition the deindustrialisation of Britain (due to the export of capital in search of super profits) is further entwined with our lack of food security (due to the degradation of the industrial capacity that’s needed to support farming in Britain).

The obvious implication of all of this is that just as the deindustrialisation of Britain by the rule of finance capital cannot be halted or reversed without the working class taking power, nor can we stop the gradual slide in our food security, sustainability and sovereignty. Just as with other industries, subsidies and tariffs, sometimes termed an ‘active industrial policy’, aren’t capable of reversing a crisis that is actively produced by the economic system, not as a policy ‘choice’ but by the material tendency for ‘free competition’ capitalism to develop into monopoly – that is: imperialism. Our current system, including the subsidies is only capable of keeping parts of our food system in the domestic economy by keeping the most capital-intensive sectors of agriculture profitable for finance capital. Reversing our lack of food sovereignty means taking on the banks and other financial institutions that milk interest from farming and speculate on the land, it means preventing the export of capital to produce food and inputs like machinery and fertilisers where labour can be employed more cheaply.

Only under socialism can we rebuild agriculture in Britain into a system that can feed and nourish our class, providing high-quality, nutritious, affordable and locally produced food for the whole population. With a planned economy we could actively build the productive forces here, rebuild highly skilled and motivated rural proletariat along with the industrial capacity to supply the machinery and other inputs needed. By breaking the link between finance capital and our farms we can address environmental challenges with scientific planning in a way that protects and supports our food security.

NOTES

1. DeFRA, United Kingdom Food Security Report 2024 https://www.gov.uk/government/statistics/united-kingdom-food-security-report-2024

2. Ibid, page 211

3. Ibid, Figure 2.1.2d, page 139

4. Ibid, page 150.

5. Farm Business Survey 2024, Data Tables 6.18

6. Defra, United Kingdom Food Security Report 2024, page 228

7. Marx, Capital Volume 3, Chapter 13, page 138

8. Defra, Total income from farming in the UK in 2024 https://www.gov.uk/government/statistics/total-income-from-farming-in-the-uk/total-income-from-farming-in-the-uk-in-2024

9. Marx, Capital Vol 3, Analysis: Chapter 46, page 510; Land speculation definition: Chapter 38 page 440.

10. Defra, Farm Rents in England, 2023/24 – statistics notice

11. Carter Jonas, Farmland Market Review 2024, Q3 update.

12. Knight Frank, Farmland Index, 2025, Q2 update.

13. https://tlio.org.uk/a-personal-project-to-save-the-world-nothing-beats-land-bill-gates-is-now-americas-biggest-farmer/

14. Edmunds, The European Conservative, Labour’s Ideological War on the Kulaks, March 14, 2025 https://europeanconservative.com/articles/commentary/labours-ideological-war-on-the-kulaks/

15. Defra Agricultural workforce in England at 1 June 2025, https://www.gov.uk/government/statistics/agricultural-workforce-in-england-at-1-june/agricultural-workforce-in-england-at-1-june-2025

16. Carter Jonas, Farmland Market Review 2024, Q3 update.

17. Defra, Landscape Recovery, round two, Policy paper, 18-10-2023.